June 13, 2024

Hudson Cook Enforcement Alert: CFPB Enforcement Order Registry Requirements Effective September 16

| HIGHLIGHTS:

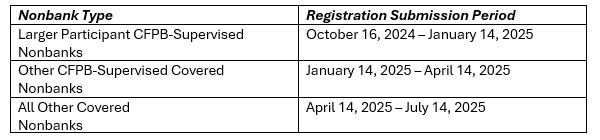

SUMMARY: Who's Covered: Registrations and Written Statements Generally, a covered nonbank with a covered order in effect on or after September 16, 2024, must register and submit information to the CFPB about the entity and the covered order. A covered order is a final, written public order (including consent orders) effective on or after January 1, 2017, obtained by a federal, state, or local agency and issued by an agency or court with public provisions requiring or limiting certain actions based on alleged violations of covered laws. Covered consumer financial services laws that trigger reporting obligations include federal consumer financial laws, other laws enforced by the CFPB (e.g., Military Lending Act), and certain federal and state unfair, deceptive, or abusive acts or practices (UDAAP) laws. Covered nonbanks with covered orders must submit identifying corporate and affiliate information and a copy of the covered order, and must identify the issuing agency, effective date, date of expiration, covered laws, and the identifying docket number or case information about the order. Additionally, for larger covered nonbanks subject to CFPB supervision, a written statement by a senior "attesting executive" describing an entity's ongoing compliance with the terms of an order must be filed annually. Generally, this requirement applies to nonbanks subject to CFPB supervision with at least $5 million in qualifying annual receipts. An attesting executive designated by the covered nonbank must describe steps (s)he has taken to review and oversee the prior year activities subject to the order, and to state whether the covered nonbank identified any violations or noncompliance with applicable obligations in public provisions of its order. For any NMLS-published covered order, a covered nonbank that identifies itself and the order to the CFPB may avoid additional registration and the annual written statement requirement. Registration Deadlines Initial registrations by covered nonbanks must be filed in the applicable submission period:

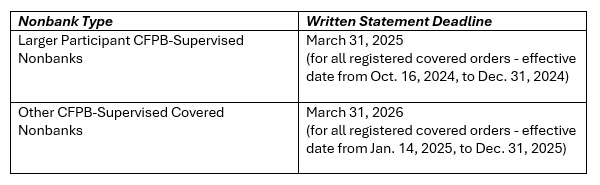

Updates to the initial registration must be made within 90 days of: updates to the nonbank's identifying or administrative information, amendments to covered orders, new covered orders, or terminations or expirations of registered covered orders. Additionally, written statements are due for larger CFPB-Supervised Nonbanks on the following schedule:

RESOURCES: Covered entities operating under covered enforcement orders are required to register with the Consumer Financial Protection Bureau (CFPB) as early as October 16. Hudson Cook LLP is prepared to assist clients in understanding and preparing for registration obligations and accompanying exposures related to their federal, state, and local enforcement orders and consent decrees. To learn more, contact your attorney or Jay Harris in our Washington, DC office at jharris@hudco.com. Hudson Cook LLP will host a webinar Thursday, June 27, at 2 pm ET to describe the rule, explore coverage scenarios, and suggest preparation steps. Click here to register. Enforcement Alerts by Hudson Cook, LLP, written by the attorneys in the firm's Government Investigations, Examinations and Enforcement and Litigation practice groups, are provided to keep you informed of federal and state government enforcement actions and related actions that may affect your business. Please contact our attorneys if you have any questions regarding this Alert. You may also view articles, register for an upcoming CFPB Bites monthly webinar or request a past webinar recording on our website. |